The Tabby UAE module for OpenCart basically installs the Tabby payment gateway inside the checkout procedure of an OpenCart store; hence, it will ensure that customers can split their payment into interest-free installments or defer it to a later date. With this module, customers in the United Arab Emirates can choose Tabby as one of their preferred methods for checking out, which gives the user a seamless experience.

Key Features of the Tabby UAE Module for OpenCart

1. BNPL Integration:

- Allows the customer to pay split or delay payments, hence has flexibility and has more purchasing power.

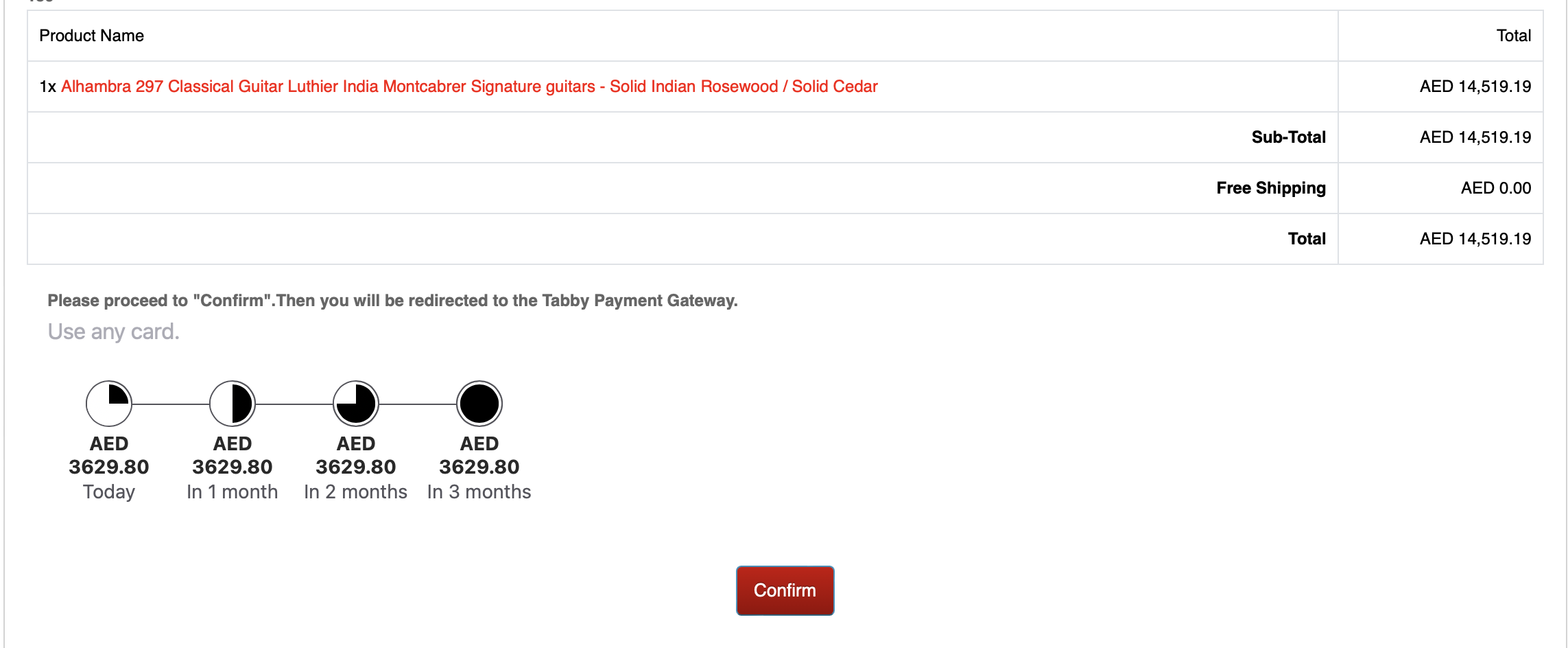

2. Dynamic Payment Options:

- Different payment structures, such as 4-month instalment plans or "Pay Later" options for the customers.

3. Real-Time Credit Approval:

- Tabby makes use of real-time data in rating clients rapidly based on credit, so that they get instant approval at the moment when they need it, not leaving the website.

4. Easy Installation and Setup:

- It has fewer technical requirements; therefore, the setup of the module will be documented for easy integration with OpenCart.

5. Multilingual and Multi-Currency Support:

- Multiple in-store languages and currencies, particularly with having globally targeted customers and with shopping online.

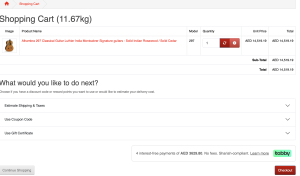

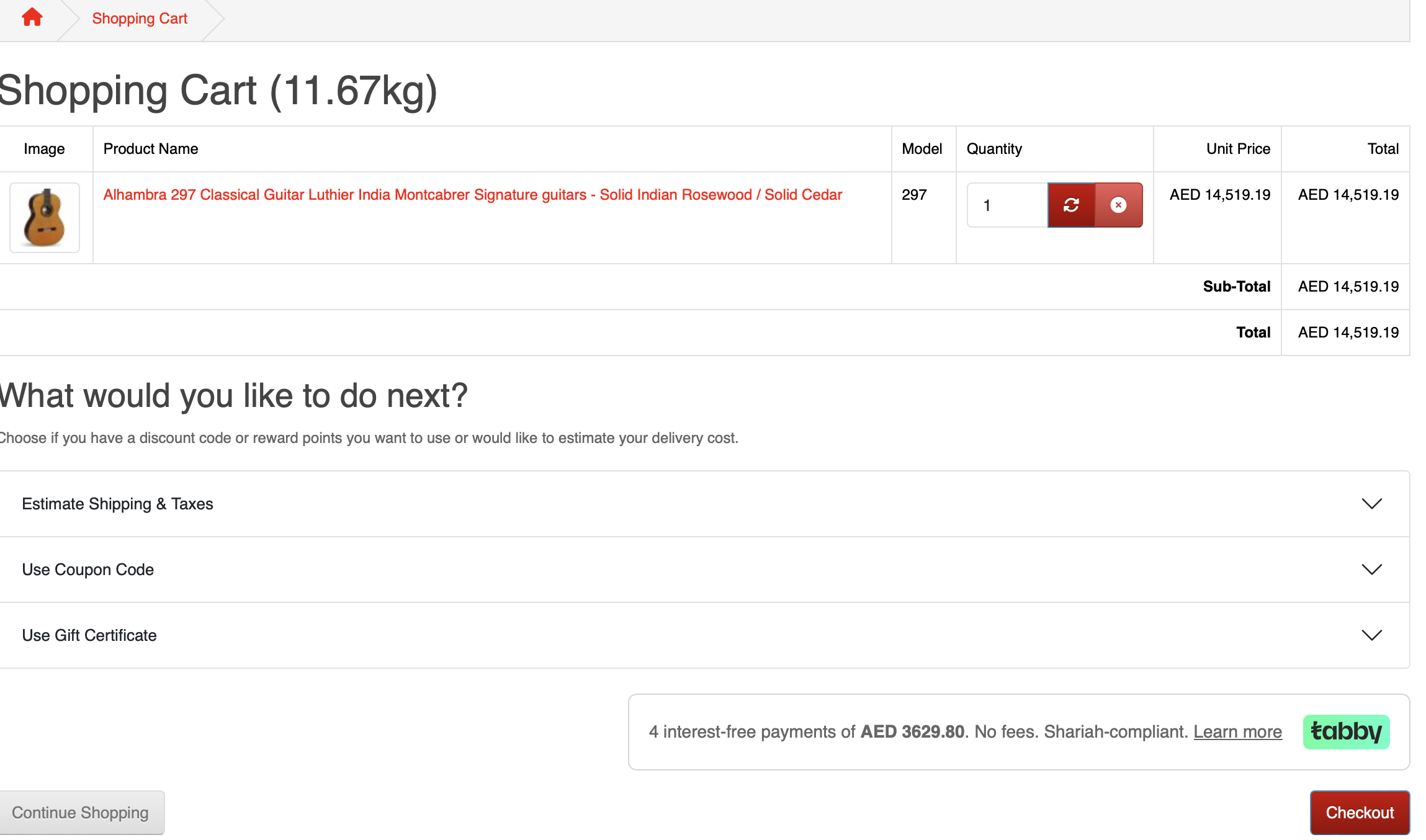

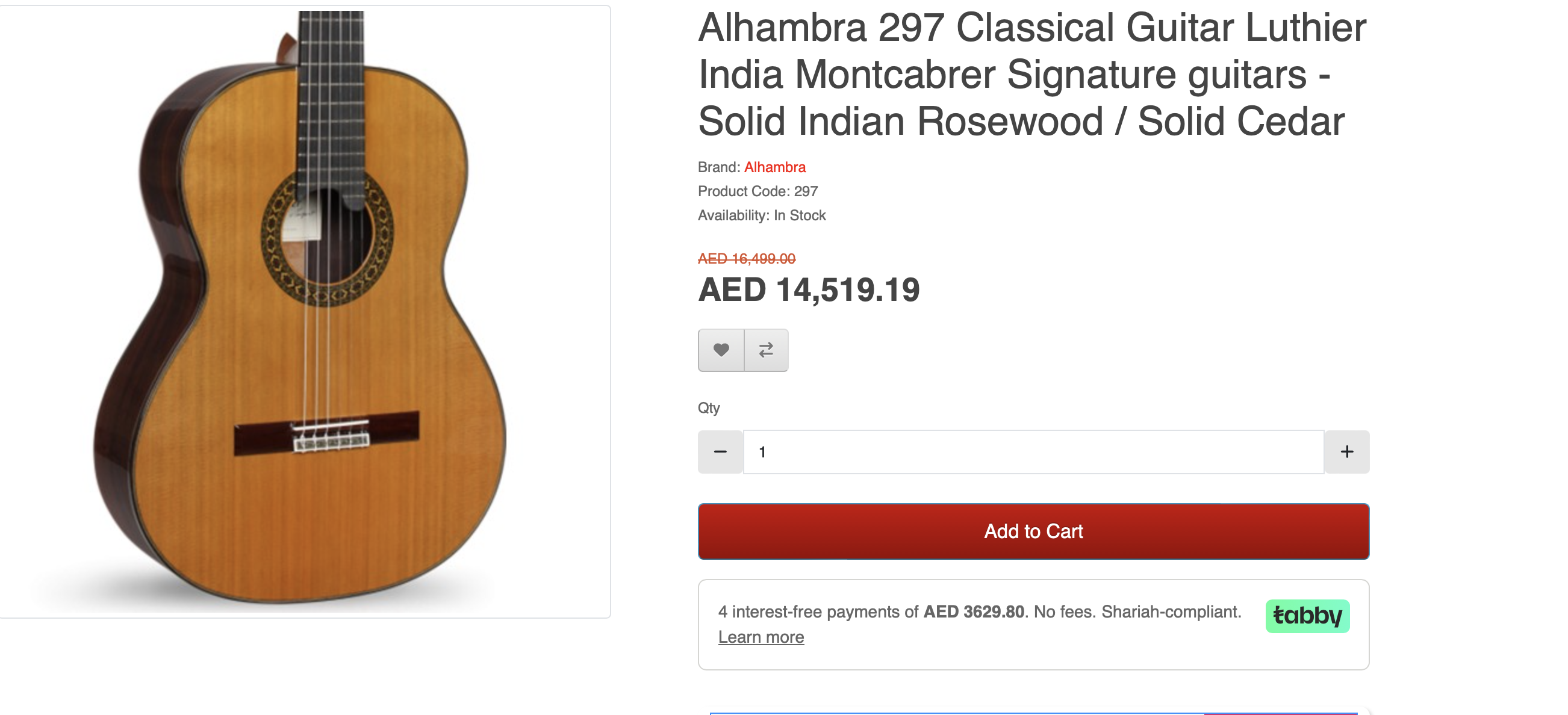

6. Customizable Payment Messaging:

- Merchants can show Tabby's payment methods on product and cart pages, nudging customers toward pay-by-instalment payments before checkout occurs.

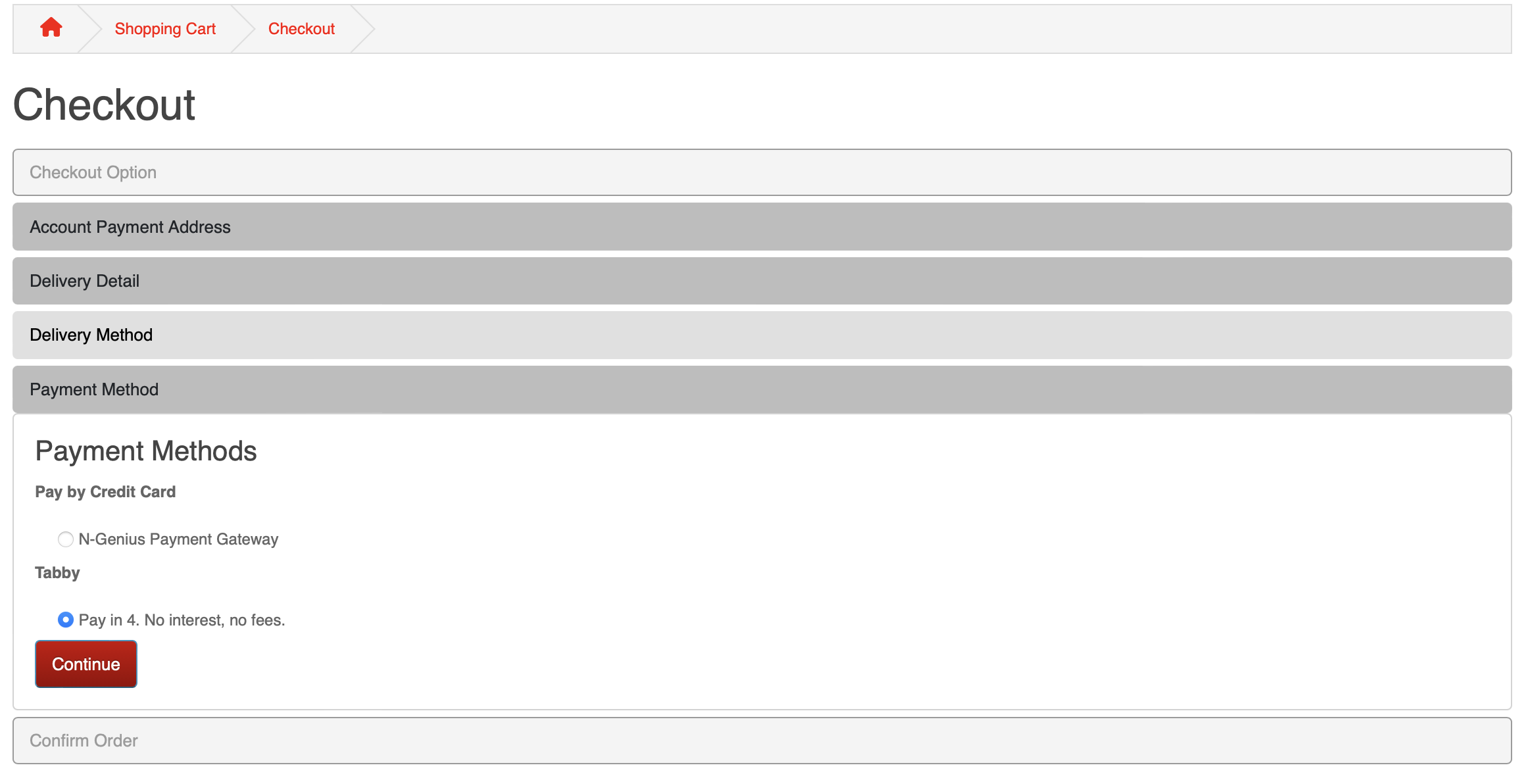

7. Flexible Checkout Flow:

- Integrates with OpenCart checkout flow, enabling customers to choose Tabby as their payment option at checkout without disrupting the flow.

8. Detailed Analytics and Reporting:

- Gives insights into customer transactions and sales performance through Tabby's analytics, enabling merchants to see how BNPL impacts revenue.

9. Secure Payment Processing:

- Tabby ensures PCI-compliant, secure transactions, protecting both customers and merchants from fraud.

10. Support for Refunds:

- In OpenCart, sellers can make partial or full refunds directly and in a straightforward manner, where the amount of the refund flows back to the customer based on their schedule of Tabby instalments.

Benefits of Using Tabby UAE Module for OpenCart

1. Increased Sales Conversion:

- Offering BNPL generates more carts to conversion since with better flexible pay options, customers are likely to complete a purchase.

2. Higher Average Order Value (AOV):

- Flexible payment terms help the customer to spend more because they get an opportunity to pay in instalments instead of paying in full at once.

3. Attracting New Customers:

- BNPL options appeal to budget-conscious customers or those hesitant to make large purchases upfront, expanding the store’s potential customer base.

4. Improved Customer Loyalty and Retention:

- The customers that received smooth, flexible payments will easily come back to the shop and make future purchases. Such makes them increase loyalty and retention.

5. No Added Financial Risk for Merchants:

- Tabby takes the risk of pay-later installment payments, so merchants receive the full amount of payment before the very first worry of customer failure.

6. Enhanced Competitive Edge:

- Offering a BNPL choice is turning out to be the competitive advantage in the world of e-commerce, especially in the regions where Tabby is a household name.

7. Smooth Integration and Maintenance:

- As soon as it is installed, the Tabby UAE Module for OpenCart works on the shopping checkout process without requiring much labour to maintain.

No data found

No reviews found